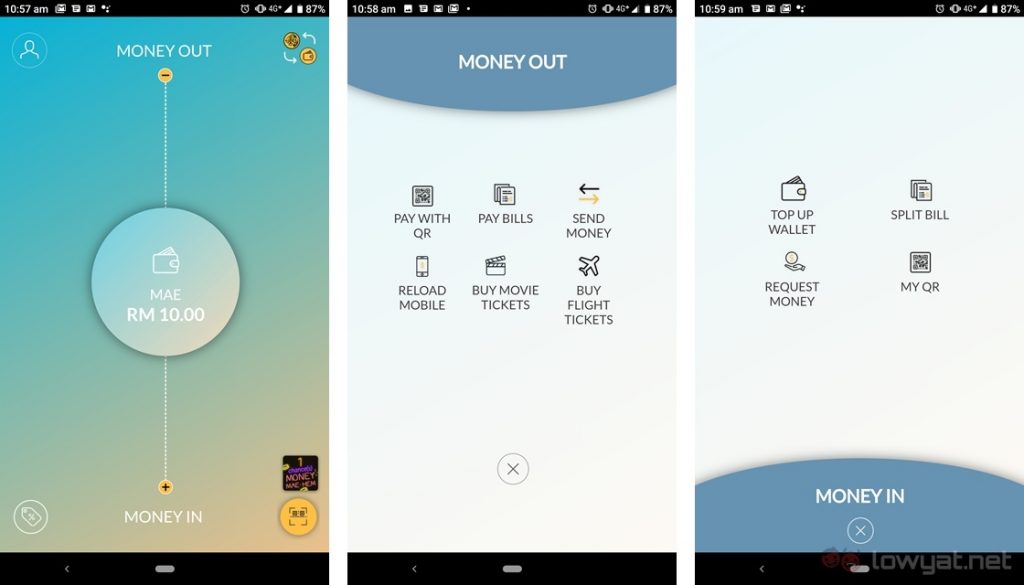

Essentially, the main use case scenario for MAE is for you to have a virtual account separate from the primary account. You still get all the features, like transferring funds and splitting bills. That said, having a separate, virtual account may make it easier to keep track of your expenses.

For those who don’t have Maybank accounts, you’ll still be able to make use of the MAE. All you need to do is to transfer money in from any other bank account of your choice. That said, usual bank transfer charges will apply. Non-Maybank customers will also be able to get a virtual Visa card to use with the MAE account. You can then use the virtual card at Visa Point of Sale (POS) terminals, via Maybank Pay or Samsung Pay.

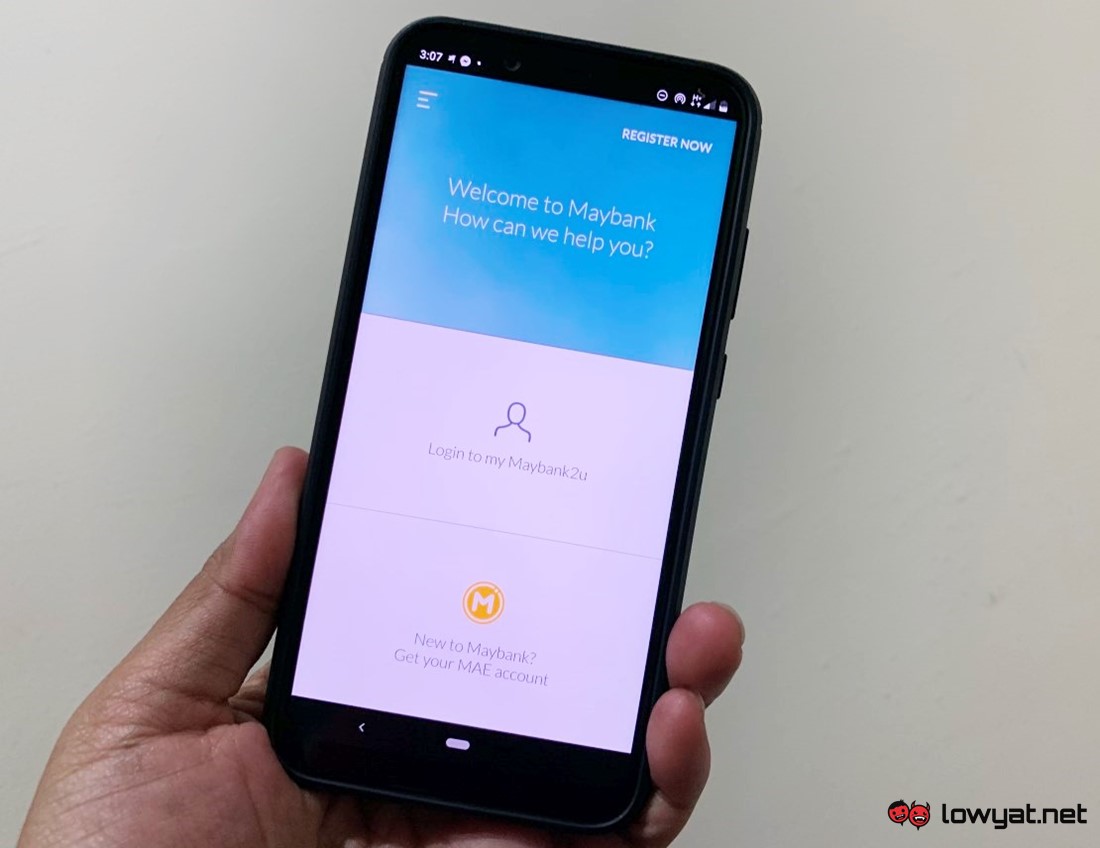

Regardless of whether you a Maybank customer or otherwise, you can check out MAE immediately by downloading the Maybank app to your Android or iOS devices. Do note that there will be some verification process involved which is common when it comes to something that related to your finances.